All Categories

Featured

Table of Contents

In the event of a gap, exceptional plan finances over of unrecovered expense basis will certainly undergo common revenue tax obligation. If a policy is a modified endowment agreement (MEC), plan loans and withdrawals will be taxable as normal earnings to the degree there are incomes in the policy.

Tax obligation regulations are subject to change and you should consult a tax professional. It is very important to note that with an external index, your policy does not directly participate in any equity or fixed earnings financial investments you are not buying shares in an index. The indexes available within the plan are created to keep an eye on diverse sectors of the united state

These indexes are criteria just. Indexes can have different components and weighting approaches. Some indexes have several versions that can weight components or may track the influence of rewards in a different way. Although an index may affect your interest credited, you can not get, straight take part in or get returns payments from any one of them with the policy Although an exterior market index might impact your passion attributed, your plan does not straight participate in any type of supply or equity or bond financial investments.

This content does not apply in the state of New York. Warranties are backed by the monetary stamina and claims-paying ability of Allianz Life Insurance Company of North America. Products are released by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Secure your liked ones and conserve for retirement at the very same time with Indexed Universal Life Insurance Policy. (Long-term Indexed Universal Life benefits)

Where can I find Indexed Universal Life Accumulation?

HNW index universal life insurance can aid accumulate money value on a tax-deferred basis, which can be accessed throughout retirement to supplement income. (17%): Insurance holders can commonly borrow against the cash value of their plan. This can be a resource of funds for different requirements, such as spending in an organization or covering unforeseen costs.

(12%): In some cases, the cash value and death benefit of these policies may be protected from lenders. Life insurance policy can additionally help lower the risk of an investment profile.

How do I get Indexed Universal Life Loan Options?

(11%): These policies use the possible to earn passion linked to the efficiency of a stock exchange index, while additionally supplying a guaranteed minimum return (Indexed Universal Life interest crediting). This can be an appealing option for those looking for development potential with drawback security. Funding for Life Study 30th September 2024 IUL Survey 271 participants over 30 days Indexed Universal Life insurance policy (IUL) might appear complicated initially, but comprehending its auto mechanics is essential to comprehending its full capacity for your financial planning

For instance, if the index gains 11% and your participation rate is 100%, your money value would certainly be attributed with 11% rate of interest. It is very important to note that the maximum passion credited in a given year is capped. Allow's claim your selected index for your IUL policy acquired 6% from the get go of June to the end of June.

The resulting interest is included in the money worth. Some plans determine the index gets as the amount of the modifications through, while other policies take approximately the day-to-day gains for a month. No interest is credited to the cash money account if the index goes down rather than up.

Who has the best customer service for Iul For Wealth Building?

The price is established by the insurance provider and can be anywhere from 25% to greater than 100%. (The insurance company can also change the participation rate over the lifetime of the plan.) For instance, if the gain is 6%, the engagement rate is 50%, and the existing money worth total amount is $10,000, $300 is included to the cash value (6% x 50% x $10,000 = $300). IUL plans commonly have a flooring, typically set at 0%, which secures your cash money value from losses if the marketplace index carries out negatively.

This offers a level of security and assurance for insurance policy holders. The passion credited to your cash worth is based upon the efficiency of the selected market index. However, a cap (e.g., 10-12%) is usually on the optimum passion you can earn in a given year. The portion of the index's return credited to your money worth is figured out by the participation price, which can vary and be changed by the insurance provider.

Store around and compare quotes from different insurance provider to discover the best policy for your requirements. Very carefully review the policy images and all terms and conditions before making a decision. IUL involves some level of market threat. Before picking this kind of plan, guarantee you fit with the potential fluctuations in your cash worth.

Is Tax-advantaged Indexed Universal Life worth it?

Comparative, IUL's market-linked cash worth development offers the possibility for higher returns, specifically in beneficial market problems. This capacity comes with the danger that the supply market performance might not provide constantly stable returns. IUL's adaptable costs payments and flexible death benefits provide versatility, interesting those seeking a policy that can develop with their transforming economic situations.

Indexed Universal Life Insurance Coverage (IUL) and Term Life Insurance are various life plans. Term Life Insurance covers a specific duration, commonly between 5 and 50 years.

It appropriates for those seeking momentary protection to cover details economic responsibilities like a home mortgage or youngsters's education and learning fees or for company cover like investor protection. Indexed Universal Life (IUL), on the other hand, is an irreversible life insurance coverage policy that offers insurance coverage for your whole life. It is more pricey than a Term Life plan since it is developed to last all your life and provide an ensured cash payment on fatality.

Who provides the best Indexed Universal Life Investment?

Choosing the ideal Indexed Universal Life (IUL) plan is concerning locating one that straightens with your monetary objectives and take the chance of tolerance. An educated financial consultant can be important in this procedure, guiding you through the complexities and ensuring your chosen policy is the best fit for you. As you research buying an IUL plan, keep these crucial considerations in mind: Comprehend just how credited rate of interest are connected to market index efficiency.

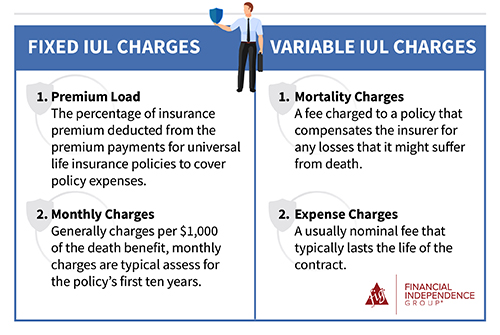

As laid out earlier, IUL plans have various fees. Understand these costs. This determines just how much of the index's gains add to your cash money worth growth. A higher rate can boost potential, yet when comparing plans, assess the money worth column, which will help you see whether a greater cap rate is much better.

Who provides the best Iul Death Benefit?

Different insurance firms supply variations of IUL. The indices tied to your policy will straight influence its performance. Flexibility is crucial, and your policy ought to adjust.

Latest Posts

Best Guaranteed Universal Life Insurance Companies

Iul Master

Nationwide Index Universal Life